TORONTO, ON (August 19, 2022) - EQ Inc. (TSXV: EQ) (“EQ Works” or the “Company”), a leader in geospatial data and artificial intelligence driven software, announced its financial results today for the second quarter ended June 30, 2022.

Announcing the Company’s highest second quarter revenue in over a decade, EQ reported revenue of over $3.2 million, an increase of 19% over the previous quarter and an increase of 8% compared to the second quarter of 2021. This revenue growth resulted from 11 new client engagements during the quarter and the Company’s continued focus on key verticals, including financial services, automotive, and retail. Data revenue also experienced significant growth in the quarter, resulting in a 56% increase over the previous quarter and 14% compared to the same period a year ago, as demand continued to increase for EQ’s proprietary data solutions.

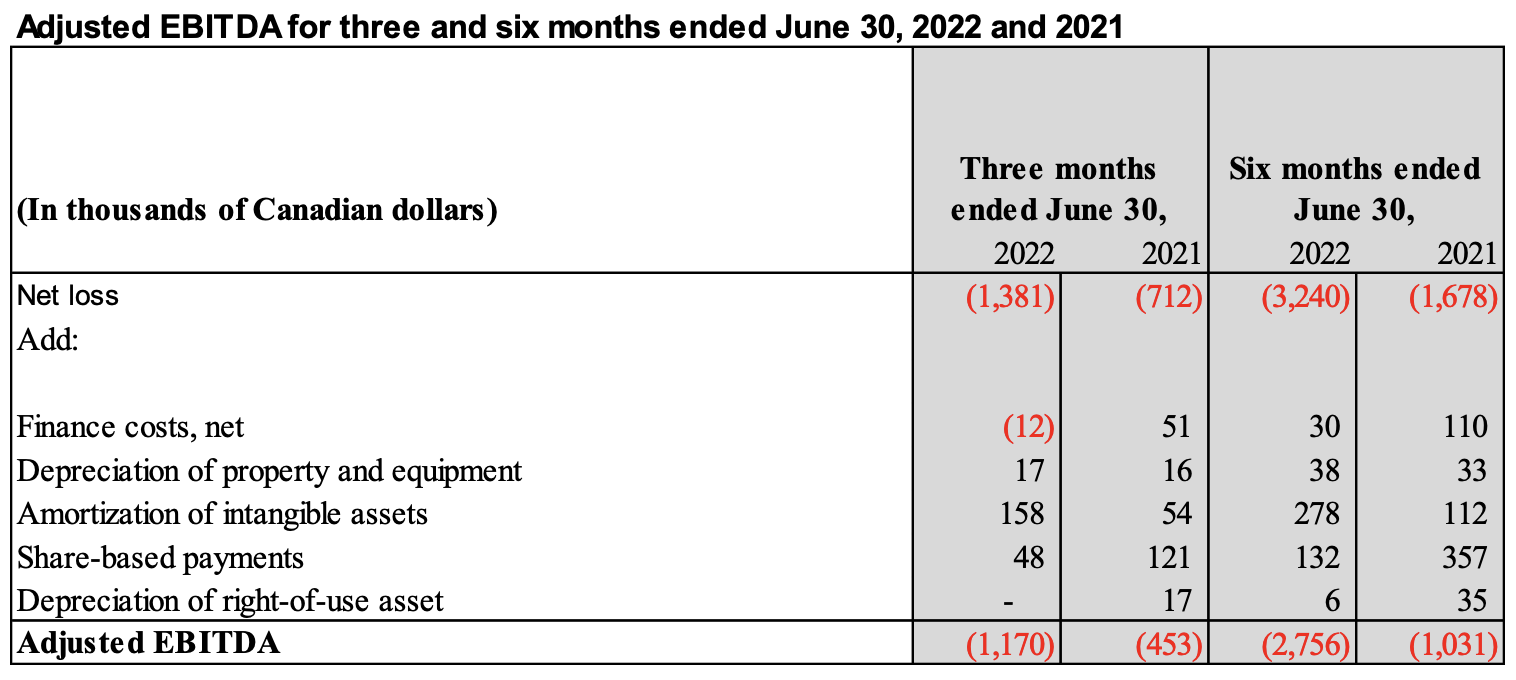

Consistent with the Company’s well-articulated investment strategy, and as a result of growing market demand for data solutions, the adjusted EBITDA loss for the quarter of approximately $1.2 million was in line with forecasts. It represents the Company’s continued investments in AI and data products both of which are expected to drive growth in recurring revenue and earnings for the later part of this year and into 2023.

The Company’s continued investment in its AI and data products progressed significantly during the quarter as it rolled out its data insights tools. Initial feedback from customers for these tools and dashboards has been highly positive for both the retail and automotive products and has confirmed that EQ’s solutions are significantly more intelligent and more insightful than anything currently in the market.

The automotive and retail verticals both represent multi-billion-dollar industries, and the Company expects these solutions to address a significant market need. Requests to join the initial beta program are well above expectations and as a result, the Company is anticipating more new client engagements during the second half of the year.

With the foundation of the data products completed, and market conditions becoming increasingly turbulent, the Company has decided to increase focus on its go-to-market strategies and slow down its investments in R&D and new product development. By concentrating on monetizing the investments made over the past 12 months and taking advantage of the considerable market opportunities, the Company is very excited about the initial sales and marketing initiatives and the enthusiasm generated by its clients.

Highlights for the Second Quarter ended June 30, 2022

Revenue for the second quarter of over $3.2 million, was an increase of 19% from the previous quarter and an increase of 8% compared to the second quarter of 2021;

Data revenue for the second quarter of approximately $0.9 million, was an increase of 56% from the previous quarter and an increase of 14 % compared to the same period a year ago;

Retail dashboarding product was rolled out in beta during the quarter and incorporates hundreds of millions of transactions and billions of dollars of consumer spend, into a solution that provides significant insights and a deeper understanding into consumer trends and behaviour in Canada;

Data integration completed with one of the largest automotive solution providers to create Canada’s leading automotive data management platforms and reinforce EQ’s strength in the automotive vertical; and

35% increase in the number of new merchant partners for Paymi, including tier 1 brands like Mastermind Toys, Skip the Dishes and Comark.

“Once again, our team delivered strong results this quarter and we are very pleased with our strategy as we continue to roll out new solutions,” said Geoffrey Rotstein, President, and CEO of EQ Works. “Our innovation, our product development and our constantly optimized value proposition continues to drive value to our clients. Our new data insights tools, for the retail and automotive verticals, are differentiated from anything else in the industry and will be essential for any business looking to make data-based decisions.”

Subsequent to quarter-end, the Company granted 75,000 stock options to employees of the Company. These stock options are exercisable at CDN $1.14 per stock option and will expire on August 18, 2027. These stock options vest over a period of thirty-six months following the grant date and are governed by the terms and conditions of the Company's stock options plan. Following this grant of stock options, the Company has a total of 2,696,000 stock options outstanding representing approximately 3.9% of the outstanding common shares of the Company.

Non-IFRS Financial Measures

EQ Works measures the success of the Company’s strategies and performance based on Adjusted EBITDA, which is outlined and reconciled with net income (loss) in the section entitled “Reconciliation of Net Loss for the period to Adjusted EBITDA” in the MD&A. The Company defines Adjusted EBITDA as net income (loss) from operations before: (a) depreciation of property and equipment and amortization of intangible assets, (b) share-based payments, (c) finance income and costs, net, and (d) depreciation of right-of-use assets. Management uses Adjusted EBITDA as a measure of the Company's operating performance because it provides information on the Company's ability to provide operating cash flows for working capital requirements, capital expenditures, and potential acquisitions. The Company also believes that analysts and investors use Adjusted EBITDA as a supplemental measure to evaluate the overall operating performance of companies in its industry.

The non-IFRS financial measure is used in addition to, and in conjunction with, results presented in the Company’s consolidated financial statements prepared in accordance with IFRS and should not be relied upon to the exclusion of IFRS financial measures. Management strongly encourages investors to review the Company's consolidated financial statements in their entirety and not rely on any single financial measure. Because non-IFRS financial measures are not standardized, it may not be possible to compare these financial measures with other companies' non-IFRS financial measures having the same or similar names. In addition, the Company expects to continue to incur expenses similar to the non-IFRS adjustments described above, and exclusion of these items from the Company's non-IFRS measures should not be construed as an inference that these costs are unusual, infrequent, or non-recurring.

The table below reconciles net loss from operations and Adjusted EBITDA for the periods presented:

About EQ Works

EQ Works (www.eqworks.com) enables businesses to understand, predict, and influence customer behaviour. Using unique data sets, advanced analytics, machine learning, and artificial intelligence, EQ Works creates actionable intelligence for businesses to attract, retain, and grow the customers that matter most. The Company’s proprietary SaaS platform mines insights from movement and geospatial data, thereby enabling businesses to close the loop between digital and real-world consumer actions.

Neither the TSX-V nor its Regulation Services Provider (as that term is defined in policies of the TSX-V) accepts responsibility for the adequacy or accuracy of this release.

Forward-Looking Statements

Certain statements contained in this press release constitute “forward-looking statements”. All statements other than statements of historical fact contained in this press release, including, without limitation, those regarding the Company’s future financial position and results of operations, strategy, plans, objectives, goals and targets, and any statements preceded by, followed by or that include the words “believe”, “expect”, “aim”, “intend”, “plan”, “continue”, “will”, “may”, “would”, “anticipate”, “estimate”, “forecast”, “predict”, “project”, “seek”, “should” or similar expressions, or the negative thereof, are forward-looking statements. These statements are not historical facts but instead represent only the Company’s expectations, estimates, and projections regarding future events. These statements are not guarantees of future performance and involve assumptions, risks, and uncertainties that are difficult to predict. Therefore, actual results may differ materially from what is expressed, implied, or forecasted in such forward-looking statements. Additional factors that could cause actual results, performance, or achievements to differ materially include, but are not limited to, the risk factors discussed in the Company’s MD&A for the quarter ended June 30, 2022. Management provides forward-looking statements because it believes they provide useful information to investors when considering their investment objectives but cautions investors not to place undue reliance on forward-looking information. Consequently, all of the forward-looking statements made in this press release are qualified by these cautionary statements and any other cautionary statements or factors contained herein, and there can be no assurance that the actual results or developments will be realized or, even if substantially realized, that they will have the expected consequences to, or effects on, the Company. These forward-looking statements are made as of the date of this press release, and the Company assumes no obligation to update or revise them to reflect subsequent information, events, or circumstances or otherwise, except as required by law.

EQ Inc. • Peter Kanniah, Chief Financial Officer • press@eqworks.com